THE MORNING LINE

The ‘Wealth Effect’ Is a Delusion and a Fraud

The so-called ‘wealth effect’ is the Tulipmania of this era on steroids, creating untold sums of money from speculative spume. If materializing vast quantities of spendable cash is the goal, a revved-up wealth effect makes the Fed Open Market Committee look like a ladies’ luncheon club. Indeed, it can take long months or even years for the central bank to stoke the consumption furnace using swaps, repos and direct purchases of Treasury debt. These obfuscations are designed mainly to make the promiscuous use of credit more attractive to everyone. However, the money must be borrowed into existence for profligacy to work its magic on the economy, and that takes time. There is a much faster and simpler way to inject cash into the system. It works every time, and the result is instantaneous, effectively showering Wall Street with a blizzard of $1000 bills.

This is a monetization trick that is not taught at Wharton. An added feature is that even Joe Sixpack can pitch in simply by buying stocks on margin. Turbocharged by a 4x multiplier and a steeply rising stock market, Joe will be driving an Escalade and living in a grandiose suburban home he will never own in practically no time.

The chart shows how it’s done, satisfying America’s money sickness in ways even the financially ingenious Dutch might not have imagined. Their seaborne empire was at its height in the 1630s, when greed and hysteria combined in just the right proportions to make the masses believe a rare tulip bulb could be worth as much as ten acres of prime farmland. The Burghers who invented the open-outcry exchange had the good sense to restrict futures trading in flower-bulb contracts in one crucial way: traders could not sell them short.

Shorts Power Bull Markets

In contrast, a key feature of today’s mania is that nearly any security can be sold short. This naturally invites the occasional short squeeze, an irresistible wave of panic buying triggered by an accelerating rise in the price of a stock that speculators have bet against. When the inevitable margin calls go out to traders suffering rapidly mounting losses, their collective short-covering gooses stocks with such force as merely bullish buying could never provide. In their eagerness to escape the vise, they jackhammer stocks through thick layers of resistance and previous peaks while sellers stand aside and let their profits run. Few pleasures in the investment world are more exhilarating than watching a stampede move one’s way.

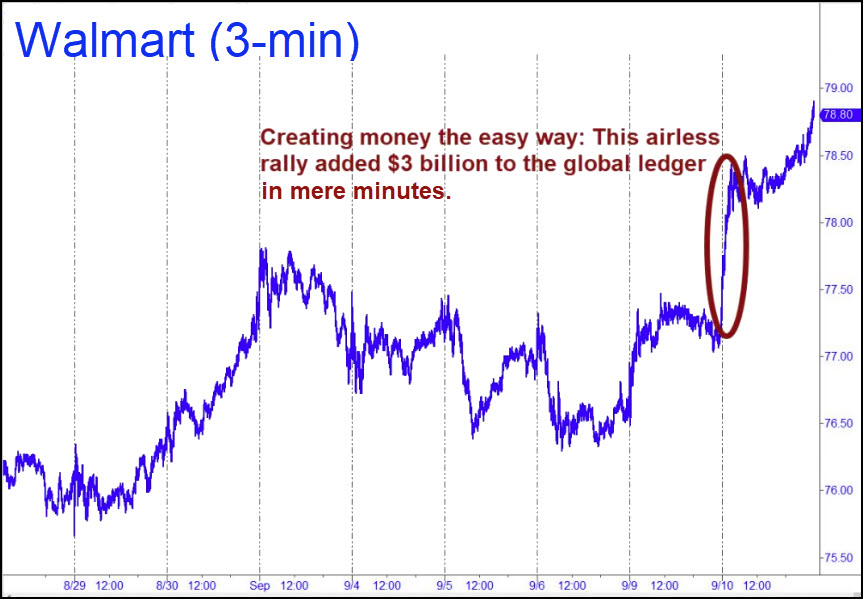

Lest the threat of catastrophe elicit a slap on the wrist from regulators, the officially sanctioned mountebanks who control the markets have mastered the art of triggering off less-noticeable mini-stampedes every morning, usually in megacap favorites such as NFLX, AMZN, GOOG, MSFT and NVDA. Hardly a day goes by when one or more of these stocks does not open on a gap like the one pictured in the Walmart chart. That nearly volumeless short-squeeze in the opening bars of the session added at least $3 billion of wealth-effect money in mere minutes. Relatively few shares changed hands as the stock spiked through a smattering of sellers.

Replicate this momentarily unhinged price action in a half-dozen mega-cap stocks routinely, and pretty soon, as the late Sen. Everett Dirksen once quipped, you are talking about real money. In 2024, Nvidia alone tacked on $2 trillion of valuation in mere months. This occurred even as other heavyweight stocks, including the once-staid IBM, were rolling up unconscionable gains.

For all the hubris, there are relatively few customers’ yachts plying the waterways. But all across America, the upper echelons of the middle class are flush with cash, eager to spend it on luxury goods. It is mostly fund managers with the financial acumen of lab rats who have racked up the biggest scores. Most of it is sitting on the books, a napping cosmos of ‘wealth effect’ money that can be hocked six ways of Sunday at the first opportunity.

Re-inflating a Pension Fund?

Unfortunately for us all, it would barely dent what we owe collectively. That is such an enormous sum that even tens of trillions of dollars of ‘wealth effect’ money cannot begin to pay off our liabilities for Medicare, Social Security and the welfare state. Wall Street’s gaseous wealth is fated to contract to nothingness in the next bear market so that the aggregate value of all publicly traded stocks would not likely bail out even a single state pension fund. Illinois seems the most likely to test this forecast, since the state’s very name is synonymous with corruption, arrantly stupid governance and reckless budgeting. But there are at least two dozen other states not far behind, and there will be no bailing them out. Only an imbecile could think ‘the Government’ will come to the rescue. Substitute the word ‘taxpayer’ for ‘Government’ and you’ll understand why. Although it is easy for ‘the Government’ to pump up financial assets and nominal GDP by monetizing debt, expanding credit and spending money it does not have, it is not possible to re-inflate a collapsing pension fund. Each sends out hundreds of thousands, or even millions, of checks every month so that recipients can pay for food, shelter, health care and other essentials. The nation’s taxpayers would quickly tire of supporting them, especially if they were all about to get stiffed themselves.

Rick's Free Picks

$TNX.X – Ten-Year Note Rate (Last:3.65%)

To this week’s list of trading ‘touts’, I have added yields on the Ten-Year Treasury Note. There seems to be a great deal of uncertainty about where rates for U.S. debt are headed, but this chart should help bring clarity and concision to the forecast. Ten-year rates have fallen from

$MSFT – Microsoft (Last:430.59)

I’ve been talking about the 449.42 rally target for more than a month, which is probably reason to think it won’t work. Still, I cannot imagine the futures blowing past it on the first try. The reverse pattern from which the target is derived is too clear and compelling not

$GDXJ – Junior Gold Miner ETF (Last:48.98)

I’ve put aside Hidden Pivots to consider the simple picture afforded by connecting up the last two important highs on GDXJ’s daily chart. They yield a rally projection to 51.19 as the week begins, but you should factor an additional 0.05 per day (or 0.25 per week) to account for

$BRTI – CME Bitcoin Index (Last:60,515)

The seemingly unstoppable rally since Bertie bottomed at 52,619 on September 6 will test the idea that the best shorts occur in places that inspire the most fear in bears. Friday’s wilding spree tripped a fearsome but technically appealing ‘mechanical’ short using the green line (x=59,858). That doesn’t mean you’re

Rick's work has been featured in

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others